Market Baseline & Momentum

Global market sizing places 2023 cosmetics revenue around USD 296 billion, with a trajectory toward ~USD 446 billion by 2030 (6.1% CAGR). Within that, APAC commanded the largest regional share in 2023 (≈45%) and continues to outpace mature Western markets in volume growth. Skincare is the anchor category region-wide, and the broader beauty rebound since 2023 has been supported by fragrance and color cosmetics recovery.

Category zoom-in: in skin care alone, APAC represented the largest regional revenue share pre-2023 and remains structurally advantaged by science-forward formats (dermocosmetics, sun care, barrier support) and pharmacy/clinic channels.

Country & Sub-Region Dynamics

China: APAC’s heavyweight continues to set the tone on innovation speed and social commerce, yet executive sentiment has normalized from the post-pandemic bounce; growth requires sharper localization and price-value architecture.

Japan: The market returned to modest real growth in 2024 (~1.1%), reaching about USD 28 billion. Premium fragrance and clinical skin care led value gains as consumers traded up for efficacy and sensoriality.

South Korea: K-beauty continues to set global benchmarks in textures, actives, and routines, with strong export-led influence across APAC. This innovation cycle strengthens dermocosmetics and hybrid care-plus-color formats across the region.

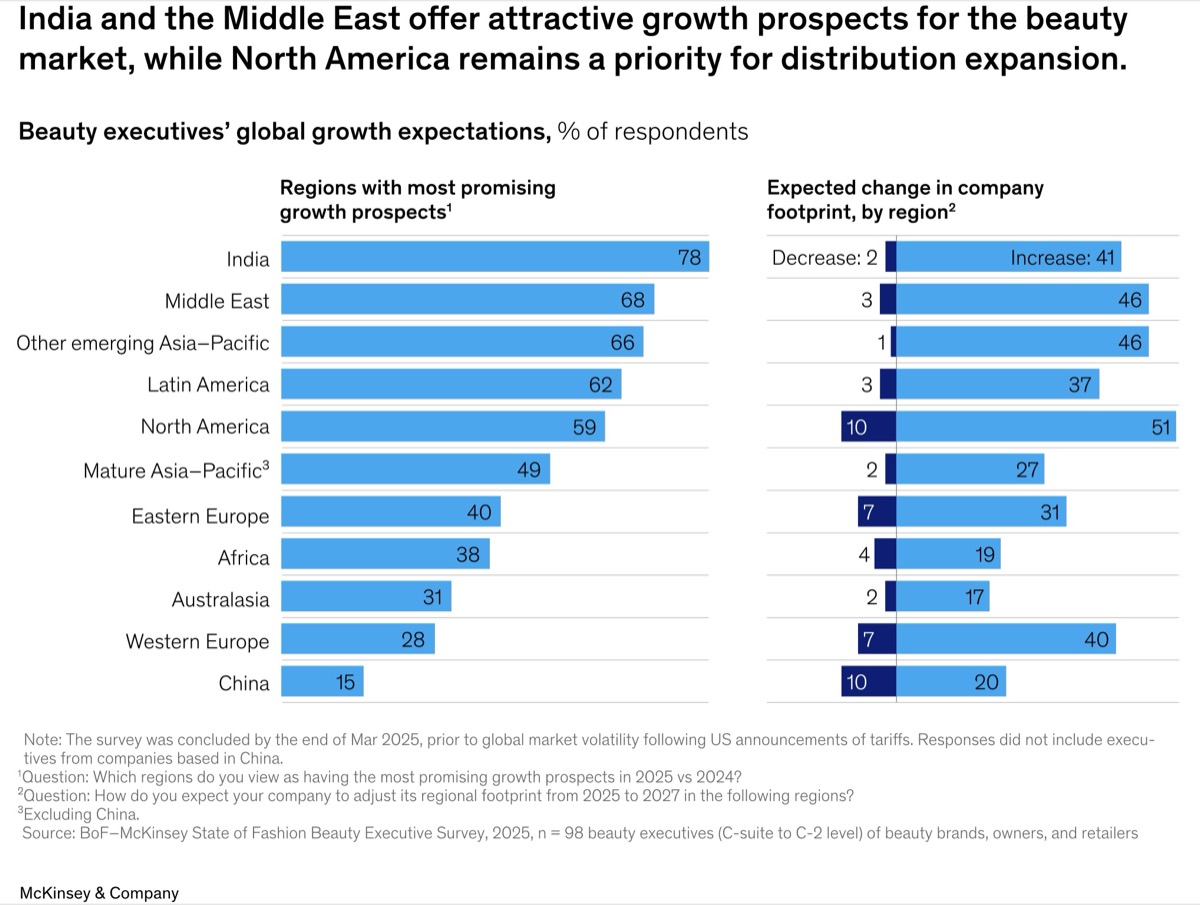

India & Emerging Asia: Executives view India and (wider) emerging Asia as the brightest volume growth spots through 2030, provided brands localize benefits, pricing, and distribution for mass-to-premium bridges.

Southeast Asia (SEA): SEA is a battleground of affordability and speed. Chinese “C-beauty” challengers have rapidly taken share in mass color cosmetics; in Indonesia, seven leading Chinese brands rose from ~2% (2019) to >15% share by 2024.

Channels: Store-Led, Digitally Orchestrated

Beauty remains a sensory category, so offline channels still dominate sell-out; however, the growth delta comes from digital discovery and conversion—live-commerce, AR try-ons, pharmacy websites, and creator storefronts. Winning operators orchestrate omnichannel journeys rather than “store vs. site.”

Digitally enabled experiences are now mainstream. Large beauty groups reported triple-digit rises in virtual try-on usage, with AR/AI reducing shade-selection friction, boosting conversion, and lowering returns—capabilities that fit APAC’s mobile-first consumer behavior.

Consumer Mindset & Mix Shifts

Across APAC, consumers are shifting from “coverage” to “care”: prevention, barrier support, SPF, sensitive-skin tolerability, and science-backed claims. This favors dermocosmetics and clinical-style routines that deliver measurable outcomes. Global leaders’ 2023 disclosures showed outsized growth in dermatological beauty, mirroring APAC’s appetite for credible efficacy.

At the same time, mass-premium blurring accelerates: entry prestige and masstige “actives” allow trading up without leaving the mass shelf—especially in SEA and India. Local insurgents compete on speed, storytelling, and price-value, while incumbents leverage R&D scale and distribution depth.

Regulation & Market Access (What Operators Must Know)

ASEAN Cosmetic Directive (ACD): APAC is not a single market, but ASEAN has harmonized many cosmetic requirements to lower trade barriers across the bloc since 2008. Brands must comply with notification, safety, labeling, and ingredient annexes aligned to the ACD when operating in ASEAN markets.

China (CSAR): Since 2020, China’s Cosmetics Supervision and Administration Regulation (CSAR) upgraded oversight—registration/filing of “special” vs “general” cosmetics, new ingredient notification, efficacy claim substantiation, and post-market surveillance—raising the documentation bar but improving transparency for consumers.

Risks & Competitive Pressures

Counterfeit goods, cross-border grey markets, and fast-cycling “dupes” erode brand equity and compress price bands. Mitigation requires channel hygiene, serialization/traceability, and distinctive science-based IP that is hard to copy at equal performance. In SEA, price-disruptive C-beauty challengers force incumbents to refresh price-packs and intensify retail theatre.

Operator Playbook for APAC (2025–2030)

1) Localize science & formats: Build routines around sensitive-skin care, SPF, scalp health, and clinical actives with claims substantiation tailored to each market’s regulation and climate.

2) Orchestrate omnichannel: Keep store-led testing/consultation while scaling AR/VTO, creator commerce, and pharmacy e-retail for replenishment. Measure and optimize cross-channel paths (sample → subscribe → refill).

3) Compete on speed & proof: Match insurgents’ speed with modular innovation and rapid line extensions; differentiate with proven outcomes, verified SPF, and tolerance data to justify premium ladders in India/SEA.

4) Design for compliance: Build dossiers and labeling flows to clear ACD and CSAR efficiently; invest in ingredient governance and claims review early in the NPD process.

5) Price-pack architecture: Offer starter sizes and refillable/pouch formats to unlock new users while protecting margin in inflation-sensitive markets; lean on masstige bridges to premium.

| APAC will remain the center of gravity for beauty growth to 2030. The region’s scale, innovation cadence, and digital intensity—balanced with complex but navigable regulatory regimes—favor players who marry scientific credibility with omnichannel excellence and local cultural fluency. For Hana Global, APAC is not just a sales region; it is the proving ground for product performance, speed, and sustainable brand building. |